IDTechEx launches active RFID and sensor networks report

The IDTechExreport, "Active RFID and Sensor Networks 2011-2021," comprehensivelyanalyzes the technologies, players and markets with detailed 10-year forecasts,including tag numbers, unit prices and interrogator numbers and prices. Detailsof over 75 active RFID implementations are given along with over 100 suppliersand full technology analysis -- from printed batteries to Wi-Fi RFID to UWBtags and systems. IDTechEx constructed 10-year forecasts usefully segmented byfrequency, application, territory, etc, and illustrated by dozens of tables andfigures. The active RFID market will grow to almost 10 times its present sizeby 2020.

|

|

|

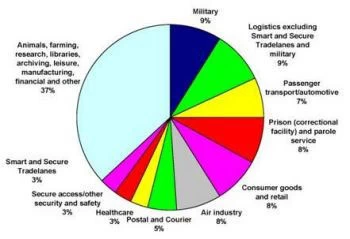

Figure. The report shows the penetration of active RFID into different application sectors over the next ten years. |

Marketforecasts

Theterm Active RFID incorporates many technologies including Real Time LocatingSystems, Ubiquitous Sensor Networksand Active RFID with ZigBee, RuBee, Ultra Wide Band and WiFi. Active RFID,where a battery drives the tag, is responsible for an increasing percentage ofthe money spent in the burgeoning RFID market. It will rise from 13% of thetotal RFID market in 2010 to 25% in 2020, meaning a huge $6.02 billion market.If we include the market for cell phone RFID modules (another form of activeRFID), the market is an additional $0.18 billion in 2010 and $1.6 billion in2020.

Factorsfor growth

Factorscreating this growth will be Real Time Location Systems (RTLS), and ubiquitousRFID sensor systems (also known as wireless sensor networks. Conventionalactive RFID used where passive solutions are inadequate and RFID modules formobile phones will make up the rest. The rapid growth of the active RFID marketis being driven by such factors as: Much stronger market demand for tracking,locating and monitoring people and things. This is driven by security, safety,cost and customer satisfaction, for example. Important factors are increasedcompetition in consumer goods, the new terrorism, internal theft, threatenedepidemics of disease, coping with increasing numbers of elderly persons andconsumers demanding better service and more information.

Reduction in cost and size of the tags and systems. With lower power circuits, button batteries are now adequate for most applications and even printed batteries are gaining a place. In future, miniature fuel cells, printed photovoltaics and other power sources will have a place. This will help to overcome constraints of lifetime, cost and size.

1. Development of Ubiquitous Sensor Networks (USN) where large numbers of active RFID tags with sensors are radio networked in buildings, forests, rivers, hospitals and many other locations.

2. Availability of open standards -- notably ISO 18000-7, IEEE 802.15.4 and NFC.

3. Leveraging many newly popular forms of short range wireless communication, particularly WiFi and ZigBee and including mesh networks

4. Use of mobile phones for purchasing, mass transit and interrogating smart posters, etc.

Active RFID sales to 2010

Tothe beginning of 2010, 772 million active RFID tags have been sold with thevast majority used for car clickers (690 million). Like these, a largepercentage of active RFID tags being sold in the future will replace nothing:they will perform new functions. The second biggest use for active RFID to datehas been by the military, using 14 million active RFID tags so far. Bothsectors have spent over $1 billion on active RFID.

Weare now in the decade of most active tags having button batteries and being thesize of a matchbox and often incorporating other radio systems, and sometimesbeing parasitic upon them in some cases. Overlapping this, we are starting thedecade or more of active RFID in the form of a label or laminate. This has beentriggered by costs of smart active labels and battery assisted passive (BAP)tags coming down, even those incorporating sensors, and their laminar batterieshaving enhanced power and life. Some will even have displays. That will run inparallel with matchbox-sized and smaller active RFID tags that areexceptionally capable, with such features as Real Time Location Systems (RTLS)and multiple sensing.

Stronginvestment

Recently,the investment community has taken even more interest in active RFID. Of 27recent fund raisings by RFID companies studied by IDTechEx, 37% of thecompanies involved are in active RFID. 22% are in the particularly popular RTLSsector. Recent acquisitions also favor active RFID companies. Indeed thelargest exit, for hundreds of millions of dollars, was a company selling activeRFID and RTLS systems.

ActiveRFID a systems business

Companiesinvolved know that this is not like the highest volume uses of passive RFIDtags where disposable labels are usually involved and the label cost can be 50%of total cost. Most active RFID (such as RTLS) is more of a systems business.

Activetag price

Withover 100 companies now involved in some part of the active RFID value chain,and considerable government financing of research on low cost active RFID, unitprices will strongly erode, creating a strong growth in numbers sold. The priceerosion will be more rapid in some years as new technologies come into playsuch as new microbatteries and printed logic.

Throughoutthe next ten years, RTLS will dominate the spend on tags but this will consistof many small orders. Mobile phone/cell phone modules will see considerableprice erosion as they are increasingly incorporated into the phone circuitryand volumes increase.

Inthe future, we see active RFID as intimately involved with many short rangeradio systems and interfaces, including passive RFID.

Analysisof Active RFID implementations

InIDTechEx's analysis of 75 active RFID case studies from 18 countries, thelargest number of projects we have located has been in Logistics with arounddouble the number for each of the nearest contenders - Air Industry,Automotive/Transportation and Healthcare. Added to those as important sectorswill be such things as safety of constructions and people monitored byUbiquitous Sensor Networks in later years. Meanwhile, RTLS is being put in about50 hospitals yearly, for staff, patients and assets. In the case studies, theitems that are tagged were mainly containers, followed by vehicles, conveyancesand people and this probably reflects the market as a whole.